Q2 2023 Flower Spending Summary

This post explores the retail data we've logged by purchasing whole flower cannabis products since October 2018. We examine price, and package size data over time and suggest some general trends in the data.

This post focuses on the spending on whole flower retail cannabis products purchased for review since October 2018. The post will examine various aspects of the data, including time, price, and package size dimensions.

The analysis will highlight trends in the prices paid for cannabis products and changes in purchasing habits since the legalization of cannabis in Canada. By delving into the data, readers will gain a deeper understanding into the prices we're paying for cannabis with repsect to time and the amount purchased.

Total Spending

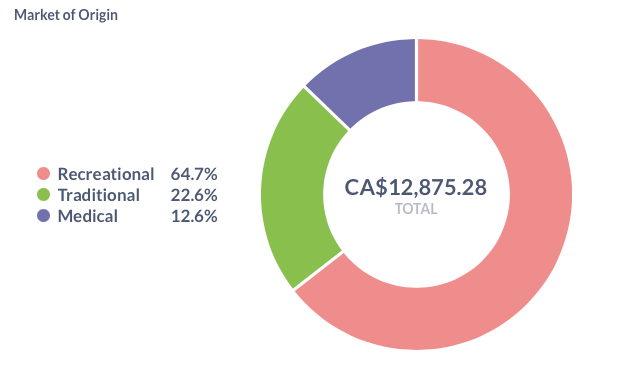

The total spending on the website for the reviewed whole flower retail cannabis products is approaching $13,000. To put it into perspective, this amount is equivalent to the purchase price of a 10-year-old Kia with nearly 160,000 kilometers on it.

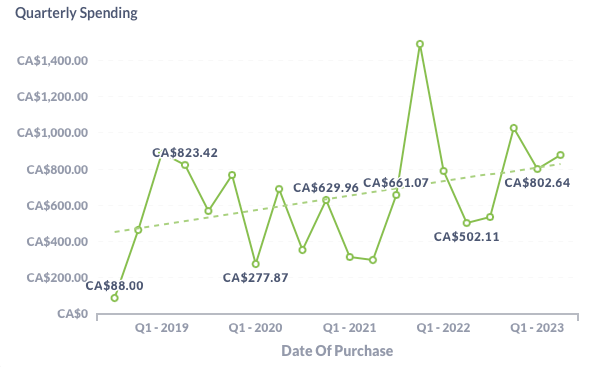

Quarterly Spending

The spending data is displayed on a quarterly basis, revealing a consistent upward trend. Initially, the quarterly spending was around $400, but it has steadily increased to approximately $800 per quarter.

Monthly Spending

For June 2023, the website's monthly spending on retail cannabis products amounts to $253. This represents a significant increase compared to May, where the expenditure was $173. June's spending is approximately 47% higher than the previous month's spending.

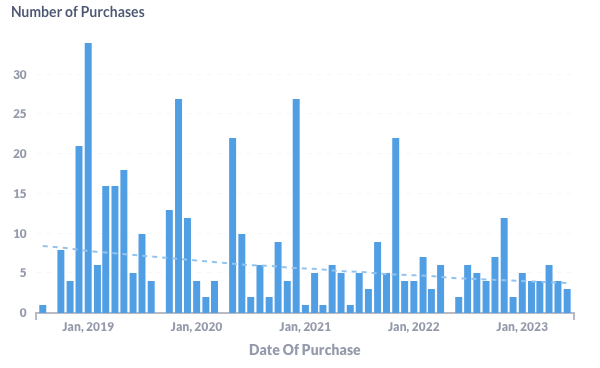

Number of Purchases

For June 2023, the website made a total of three purchases of legal retail cannabis products. This reflects a decrease of 25% compared to May, where the website made four purchases.

The frequency of monthly purchases on the website has been gradually decreasing as a result of a shift towards purchasing larger package sizes.

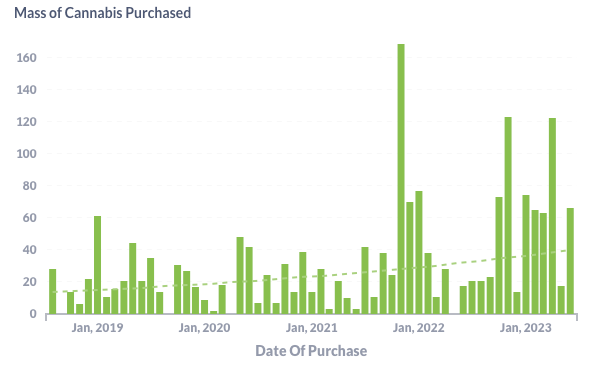

Mass Purchased

During June, the website made a purchase of 67 grams of legal retail cannabis products. This represents a significant increase of 180% compared to May's purchases of 18 grams.

On average, the monthly quantity of legal retail cannabis products purchased by the website has been increasing over time. Initially, the average monthly purchase was around 15 grams, but it has steadily risen to approximately 40 grams.

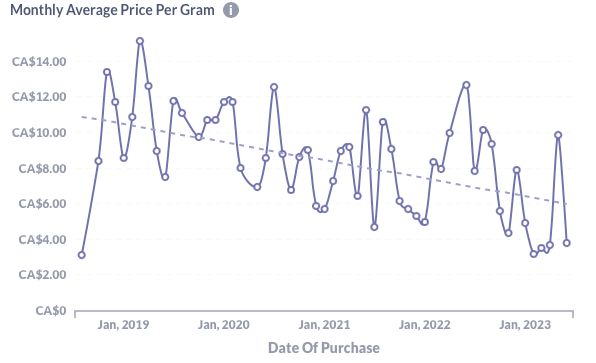

Average Unit Price Paid

This month, the website's average price per gram for the purchased legal retail cannabis products was $3.80. This reflects a significant decrease of 61% compared to the average price we paid in May ($9.86 per gram).

When plotting the average price paid per gram paid by month since 2018, a general trend emerges, showing a decrease in the average price over time. Initially, in 2018, the average price per gram purchased stood at around $11. However, as time progressed, the average purchase price has gradually declined and currently hovers around $6 per gram.

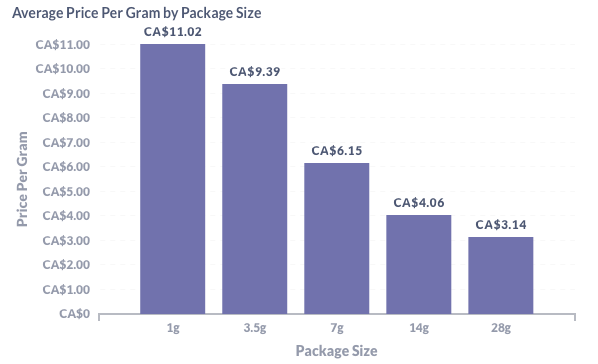

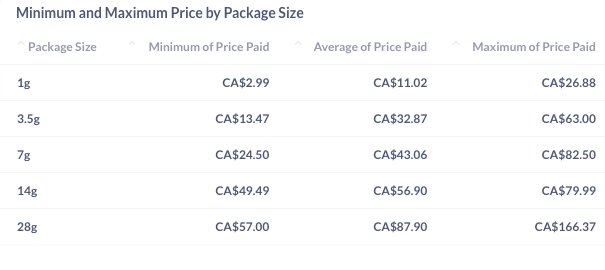

By purchasing an eighth (3.5 grams) package instead of a single gram package, there is a cost-saving of $1.63 per gram or $5.67 in total. This represents a savings of approximately 15% compared to the single gram package.

When opting for a 7-gram package over an eighth, the discount increases to $3.24 per gram or just under $23 in total. This translates to a discount of approximately 35% compared to the eighth package.

For a half ounce (14 grams), the savings amount to $2.09 per gram or just under $30 in total, resulting in a discount of around 34% compared to the quarter ounce package.

Moving up to an ounce (28 grams), the average savings amount to $0.92 less per gram or just under $26 in total. This represents a discount of approximately 23% compared to the half ounce package.

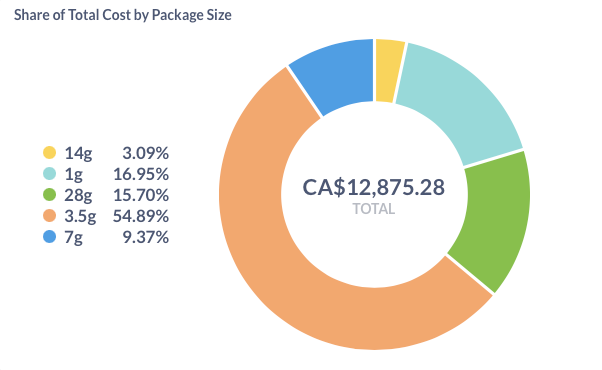

Spending by Package Size

The analysis of the website's spending reveals that the majority of the expenditures have been on 3.5-gram packages of cannabis flower. This package size accounts for the largest share of spending.

Following the 3.5-gram packages, the second most significant expenditure is on 1-gram packages of flower. Although it trails behind the 3.5-gram packages, it still represents a notable portion of the overall spending.

Interestingly, the fastest rising package size in terms of spending is ounce packages (28 grams). While currently in third position in terms of spending, we are increasingly purchasing ounce packages of cannabis flower.

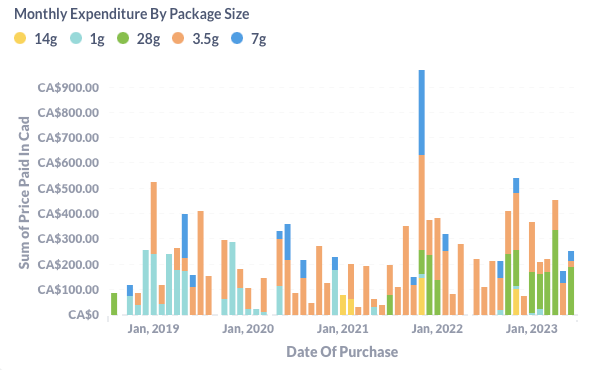

Below, the analysis showcases the sum of the retail price paid for cannabis each month, providing a breakdown based on package sizes.

Market Coverage

Since October 2018, the website has conducted reviews on a total of 158 brands of legal retail cannabis products. In June 2023, the website reviewed three brands, which is one brand fewer compared to the previous month when four brands were reviewed.

Over the course of our reviews, we have evaluated cannabis produced by a total of 142 different producers.

In June, we reviewed products from three producers, which is one producer fewer compared to the previous month when we reviewed products from four producers.

To date, the website has made purchases from a total of 40 different cannabis vendors.

In the June, we visited and made purchases from two vendors, representing a decrease of 33% compared to the previous month when we utilized the services of three vendors.

Market Source

Above, we provide an overview of cannabis sourced from three distinct markets. The majority of the cannabis purchased, amounting to 65%, was sourced from legal recreational stores in Canada.

Additionally, a portion of the cannabis, accounting for 23%, was sourced from the traditional or legacy market. The traditional market refers to the informal or unregulated sector that existed prior to the legalization of cannabis in Canada. A a smaller portion of the cannabis (12% of expenditure) was purchased from a legal store that requires a medical document.